What is Behavioral Investing & Behavioral Finance?

At an elementary level; Behavioral Investing or Behavioral Finance is the study of how our psychological preferences/biases and our behavioral patterns affect our financial decision-making ability. It may seem preliminary or even irrelevant; but you’ll be surprised to learn how much impact our collective psychological beliefs can have in the outcomes of the stock market. We have always been taught in our schools and colleges that humans are rational; that there is always some rational thought and reasoning behind why the market is behaving the way it is. As it turns out, this is not always true; the study of human behavior has revealed that there are many times when we act irrationally; we take decisions based on emotions, or our inherent psychological biases.

What is the role of Behavioral Investing?

It may seem unlikely, but collectively, this can have a huge impact on the overall performance of the stock market as well; and it does. Taking an example of the recent developments, markets all over the globe had fallen immediately after COVID-19 fear had struck the world (March 2020); however, just a few weeks later all the markets normalized to their pre-COVID levels; and if you look at the charts today, they are about to cross their all-time highs. Parallelly, no vaccination has been discovered; the economic situation of the world has still not recovered; financial results of the companies are not good. So nothing has recovered and achieved its pre-COVID levels; but the markets have still gone up and even crossed their all-time highs.

The question that must be asked is, Why? The answer is not simple and requires in-depth analysis; but most economists will point in the same direction – that investors are forward looking; and they have faith that eventually the global economic and financial situation will improve. Fact of the matter is that there is a lot of liquidity in the market i.e. many people had money with them; and didn’t know what to do. Due to COVID, many places where people would earlier spend their money had closed down, and therefore people had money but nowhere to spend it. This made them look for avenues where they can invest their money instead of keeping it in the bank account; and this is what brought in a lot of liquidity in the market.

What this culminated into was a surge in the stock prices without any correlation to the fundamentals of the market. This momentum continued and with the help of “positive future outlook” the market kept on going up. Thus, a collective bias of people (looking for avenues to invest excess money) translated into an upsurge in the stock market to the extent that it crossed its all previous levels. This is how important Behavioral Finance is in today’s world, and why you need to understand it.

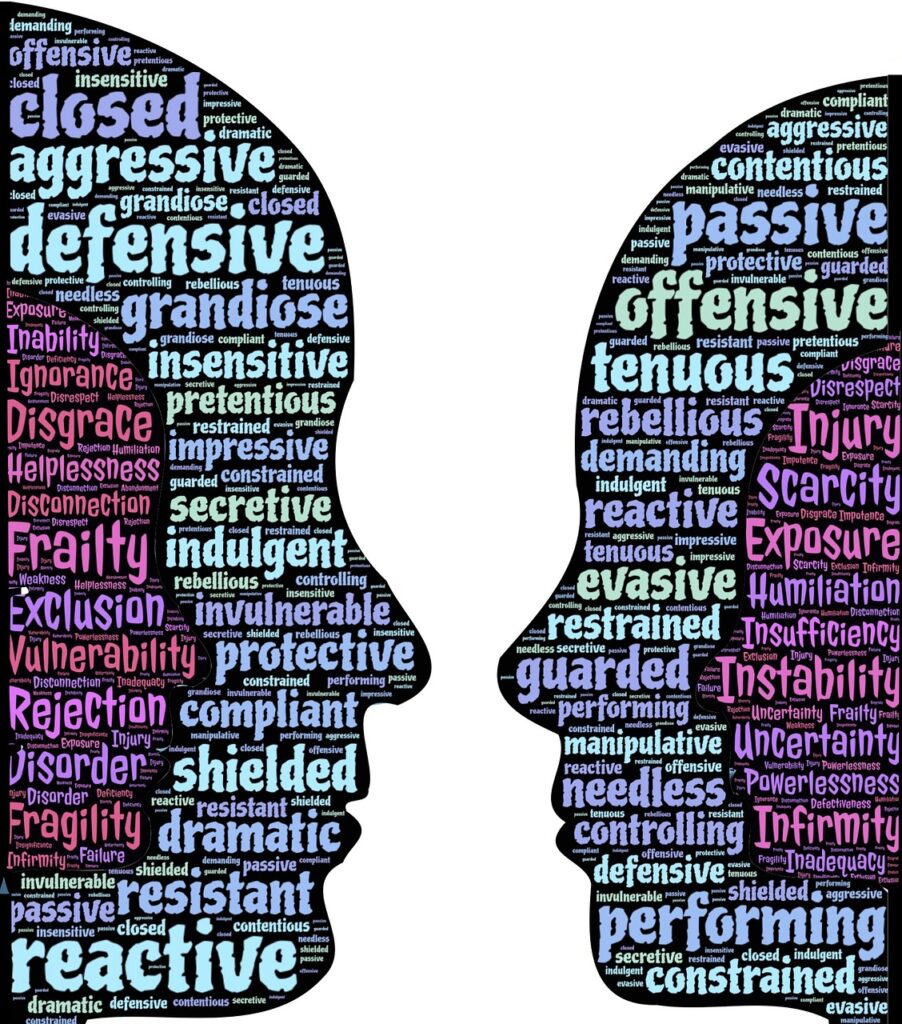

What is a Behavioral Bias? What are Behavioral Influences?

In simple terms, a behavioral bias is an inherent (also mostly irrational) belief that a person has regarding something, which signifies their preference to a certain type of thing or an individual. For example, you might have a positive behavioral bias toward tall people, this would translate into you doing business with more tall people than short ones because you’re naturally inclined toward tall people.

Behavioral Finance & The Efficient Market Hypothesis

This thing called The Efficient Market Hypothesis. Essentially, it’s well established in finance. And it says that, it’s really hard to beat the market because there’s really millions of investors out there. Many of them spend their entire lives studying one stock or one sector. Price of stocks or maybe not today, but we’ve seen a lot of panic activities recently, but stocks are generally pretty efficient, they adjust in new information, it would be hard to sort of short term make profits. That’s what the Efficient Market Hypothesis would say. Well, if that’s true, then it would be hard to imagine lots of things working that something’s which you might actually do, right? So historical stock prices really should be irrelevant, because the future only depends on new information, not on things that happen in the past.

So I’m giving you some implications for those who believe in this theory. Or fundamentals analysis. Well, you know, colleges try to teach kids how to research companies, understand future cash flow, understand their future prospects. Well, again, if you really are a slave to or you believe in the Efficient Market Hypothesis, that part doesn’t matter much because the only thing that should matter is new information. Everyone can look that up themselves. So, the point being that these guys would say, at least as the stocks are essentially random. And that’s why they would normally say, invest in index mutual funds, because it gives you the market anyway.

But are they right? Well, there’s some reason to think they might be right, because it is true that index funds have often been in history managed funds. And people are rational, and there’s really no point trying to beat the market. However, there’s lots of reasons to disagree with it. And you probably are aware a lot of these. For some reasons, small firms tend to have higher returns even after adjusting for risk.

Conclusion

Behavioral Investing means to understand that there are certain biases that people are driven by, including yourself; and that these biases can make people behave irrationally and collectively, this might result into some unexpected outcomes. Our objective is to understand what these biases are and which are the ones that affect us; so we can control our own biases and accordingly take a profitable position in the market.

Do check MKJ sir’s YouTube channel on this link!

Read our other blogs here!

Pingback: Behavioural Biases & Behavioural Finance - Manoj Kumar Jain

Please read Aditya for Ankit.

Again . Thanks Aditya👌

Muzhe trade ki jankari chahiye sir